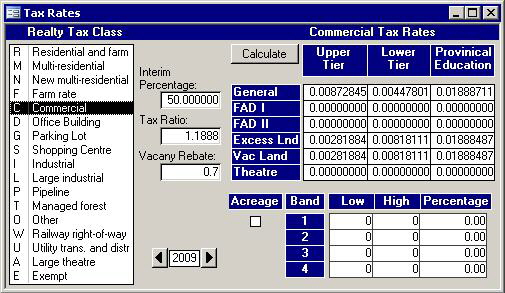

Introduction The Tax Rates screen is split into 4 sections. The first is the Realty

Tax Class that determines to which class the other 3 sections are referring. Those other sections, Tax Rates, Banding, and Other Data, can be different for each property class and are described below. Also

described below is the Calculate button.

Tax Rates At the end of each year the Treasurer calculates the tax rates using the School Board

Requisition and submits them to council for approval. The approved rates returned from council must be put into this screen. When keying in the values, make sure they are

similar to the format shown in the above picture. For example, if you type in 0.91111 instead of 0.0091111 then the rate will will be way too high. You can, of course, put in

different rates for the following qualifiers: General, Farm Awaiting Development Phase 1, Farm Awaiting Development Phase 2, Excess Land, Vacant Land, and Theatre.

Banding

Commercial properties can be put into tax rate bands where the first band has a lower

rate than the second, the second band has a lower rate than the third band if it exists, etc. This banding can be used during the final bills; not all municipalities use banding.

Other Data

There are a few extra fields on the Tax Rates screen.

- Interim Percentage:

Usually the interim taxes are determined by taking half of the previous years tax rates; however, this can be changed to a prescribed rate.

Paragraph 1 of subsection 317.(3) of the Municipal Act S.O. 2001 states:, "The amount levied on a property shall not exceed the prescribed percentage, or 50 per

cent if no percentage is prescribed, of the total amount of taxes for municipal and school purposes levied on the property for the previous year." You can use the

Interim Percentage to set the rate to the prescribed percentage to 50 per cent for each property class from fifty percent.

- Tax Ratio:

This is used in the calculation of the nominal amount for the schedules on the standardized final tax bill. It is also used to calculate the Lower Tier rates

when you use the calculate button which is explained in the next section below. Each Realty Tax Class has its own ratio with respect to the residential class. For

example, if the Tax Ratio is 2.5373 for the Multi-residential class, then the tax rate for that class will be 2.5373 times larger than the rate of the Residential class.

- Vacancy Rebate:

Each Realty Tax Class has its own vacancy rebate rate. While this is 1 for most, some classes will have a different rate. This too is used in the

calculation of the schedules for the final bill as well as the Lower Tier rates.

- Acreage:

Some Realty Tax Classes have their taxes calculated based on acreage. This box should have a check in it for those classes.

- Year:

The bottom box, flanked by the buttons with black arrows, is the year. If you want to see the rates for the previous year, then click the left button.

Clicking the button on the right will bring you back.

Calculate Button

If the amount to be raised by the Lower Tier has been specified in the budget, and that account has been added to the Setup Wizard

, then clicking this button will calculate your rates for you. It will produce a report that shows the numbers used in the

calculation as well as the total to be raised which will usually be within ten dollars of the budget amount. The discrepancy is due to round off error. |