Introduction Lawyers usually request a status report of a property, or

Tax Certificate, when that property is sold. To be able to print a Tax

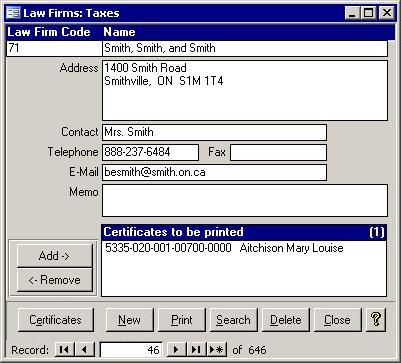

Certificate, you must first go to the Law Firms form shown below. Either find the law firm or enter the firm if they are not already listed. Adding a new Law Firm is easy. When you launch the Law

Firms form, you start at a blank record. Just start by entering a new code. If the code you entered is in use, you will be told so, and that record will be brought up. If that law firm is not the one

you need, then choose a different code. A popular way to make your own code is to use part of the name followed by a number. In the picture below, Smit01 could have been used instead of 71. Next use the

Add button to add the roll numbers of the properties for which the certificates have been requested by that law firm. Finally, click the Certificates button to see your report on the screen. Do not use the

Print button on the Law Firms form unless you only want a list of all of the law firms in the system.

Notes:

Notes:

- This is the only report in the Tax Manager that requires legal size paper.

- The Memo section of the Tax Certificate contains information input into the Tax Certificate Memo field on the

Notes

tab of the Tax Master.

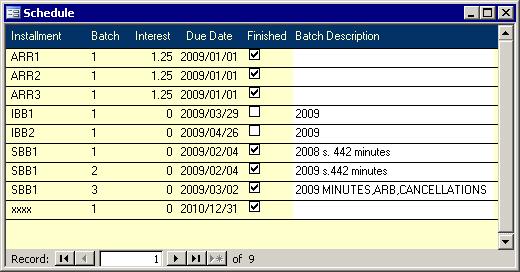

- The Due Dates section contains the due dates for each billing batch that was run up to a maximum of eleven batches.

- The Levied amount for the third year of arrears may include prior year levied amounts. The system keeps track of 6 years of arrears. The

magnitude of the outstanding amount determines how many years back will be included in the levied amount. For example, if the outstanding arrears amount is

higher than the third year levied amount, then the fourth year levied amount will be added to it. Similarly, if levied amount is still too low, then the fifth and maybe sixth year levies would be added.

- The Class Descriptions have to be input for each bill batch and can be edited by choosing Schedule from the Administration section of the Main Menu. See the Schedule form below.

|