Introduction This wizard takes you through setting up the system information. It is

automatically run when you first launch Baker and Associates software for the first time. If you do not complete the wizard, it will continue to run when you first enter the system. Once it has been

finished, it can be run at any time by the administrator. It is accessible through the Administration menu.

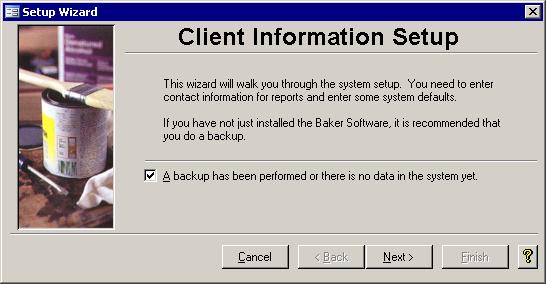

Step 1: Checklist Step 1: Checklist

Before you can begin you have to back up the system to save the previous

configuration. If you are running this Baker and Associates software for the first time, you can just check off the box by clicking in it with the mouse. Click Next to continue on.

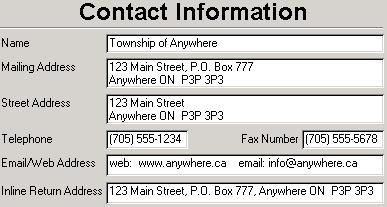

Step 2: Company Information Step 2: Company Information

The Contact Information screen is where you should key in your municipality's

name, address, etc. This data is used by several of our systems. This Municipal Tax Manager system uses the following fields: The Contact Information screen is where you should key in your municipality's

name, address, etc. This data is used by several of our systems. This Municipal Tax Manager system uses the following fields:

- Name:

The name of your municipality is used in the Title bar, and the Tax and Water certificates. It also appears beneath the logo on the Tax Menu.

- Mailing Address:

This field's data is used on the Mortgage List during the billings.

- Telephone:

Both the Mortgage List and the Supplementary letters include the information from this field in the header

- Email/Web Address:

The email/web address will appear on bills, so you could put in either a web URL, or an actual email address, or, as in the picture above, both if you choose.

- Inline Return Address:

This is used on some reports that are sent to the property owners and that do not get printed on letterhead. This address should

only be on one line and will appear on reports like Notices of Arrears

, Tax and Water Certificates, some bills, the Bulk List, and the Tax Profile. It usually appears just under the municipal name in the header.

This is just a list of the places this property tax system uses these fields. A more complete list of where each field is used can be found in the General Help's Setup page.

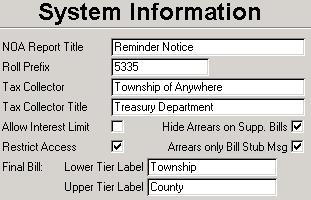

Step 3: System Information Step 3: System Information

The fields on this form are are largely unrelated and used on various forms and

reports. They are described below in turn. The fields on this form are are largely unrelated and used on various forms and

reports. They are described below in turn.

- NOA Report Title:

Some municipalites do not like to use the word "Arrears" on the Notice of Arrears report and prefer a different title. The title along the top left of

the Notice of Arrears can be set here. It would be best if it is kept short.

- Roll Prefix:

This box contains the first few numbers of your rolls. For example, if all of your rolls start with 533500001 then you could key that into the Roll Prefix

field. This will save you some typing especially when you are using the search form. (Hint: When you enter the search form and the roll prefix is highlighted in

black, press the F2 key to go to the end.)

- Tax Collector:

The Tax Collector and Tax Collector Title should show the name and title of the municipal tax collector respectively. These will show on the Supplementary Letters.

- Allow Interest Limit:

When checked, this will cause rolls that owe less than the Notice of Arrears minimum to escape from the interest run. If left unchecked, all

rolls that are in arrears will receive interest charges.

- Hide Arrears on Supp. Bills:

Because there can be some confusion with due dates, some municipalities do not show arrears amount on Supplementary bills.

Instead, the following will appear on the bill: "***This bill is in addition to any bills previously issued and does not reflect any possible arrears outstanding on this account."

- Restrict Access:

Municipalities with several employees sometimes use this to limit who has access to change bank, name and address information.

- Arrears only Bill Stub Msg:

The bill stub on the Supplementary bills can either show or hide the amount of the arrears. If they are hidden then the following will

appear: "***This bill is in addition to any bills previously issued and does not reflect any possible arrears outstanding on this account."

The reason this feature was added was to remove any question as to when the arrears are due. Take the following example. One year the final bill is run June

20th with due dates of July 31st and Aug 31st. Roll 123 gets a bill with two installments of $500 taxes due on those dates. On June 23rd, a supplementary

batch, that includes roll 123, is run with a single due date of August 2nd. The bill for roll 123 will show the arrears as $1000 due on the Aug 2nd when $500 of that

will not be past due until after August 31st. To remove this discrepancy of when the amounts are due, this Arrears only bill stub message feature can be enabled to hide previously billed amounts.

- Final Bill Labels:

The standardized bill that came out in 2003 can now be printed on mostly blank and perforated 11x17 paper. Since we now print the lines to avoid

alignment problems, we can also change the labels from the default of Lower Tier and Upper Tier to Municipality and Region, or whatever else is appropriate.

|