Introduction Rather than have a separate routine for Supplementary/Omissions, Class Changes,

Cancellations, Assessment Review Board Decisions (ARBs), and Requests for Reconsideration (Minutes of Settlement), they have all been grouped into one Assessment Adjustment/Supplementary Taxes system. For the rest

of this page, the word Supplementary will be used to include all four of these situations. Another benefit is the Dynamic Link. It allows you to run a supplementary for previous years as long as the previous

years databases exist on the server. Below is a brief description of how to enter a supplementary. If you received an MPAC Omit/Supp CD, you could also import its data using the Import found in the

Administration sub menu to get the data into the system. Once the data are in the system, you must run a supplementary billing

to update the accounts and to print any needed bills. Notes:

- You can only enter a roll more than once per batch for each year that needs

altering. If there are multiple years and multiple school supports, then it is likely that the bill will span two pages.

- Current year supplementaries, ARBs, cancellations, and class changes should be

done after the final bills

have been run; however, they could be entered before if an effective date of December 31 of the current year is used. Since supplementaries for the current year change the assessment value, the final bills will not need to be adjusted with separate supplementary bills. This makes it a little bit harder to balance the assessments, but the final bills will be correct.

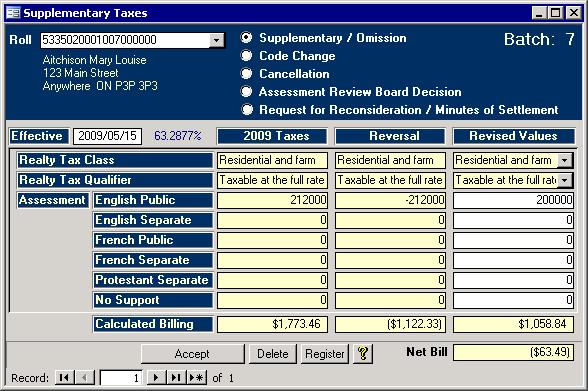

First you start by choosing the Roll then selecting the type of supplementary. Next you

must enter the effective date. The effective date is the date the adjustment takes effect. The percentage beside the effective date field represents the amount of the

year that is affected by the adjustment and is used in calculating the adjustment values. If you choose an effective date with a year for which the system has no data, you will receive an error message.

The bottom section has three columns. The first column tells you the current status as of the effective dat, and the second reverses the current settings as of the effective

date. You must fill in the Revised Values column with the information on the sheet from the Municipal Property Assessment Corporation. When done, simply click the Accept

button, and continue on with the next roll to be changed. When you are done entering all of the adjustments for the current batch, click the Register button to see the

Tax Adjustment Register. If everything is correct on the

register, then continue with the Supplementary billing. Case 1: Remove all subordinate rolls

I have been asked how to deal with ARBs where all sub rolls are being removed. This is

one way:

- Adjust the primary roll (0000), and add the school support.

- Adjust each subordinate roll and do not enter anything into the third column.

- Do the billing. The amalgamated charges will be applied to the primary roll.

Case 2: Remove all subordinate rolls for a previous year

This is done the same way as Case 1. The only difference is the effective date must change.

Case 3: Remove all subordinate rolls for a previous year that have

since been removed by the Assessment Office.

- Use the

Tax Master

to add the rolls that no longer exist in the current year, so they will show up on the list and can be used in the billing. They will be removed

again when the SAS is run next year. Since they do not have any assessment, they will not affect the Interim and Final billings.

- Adjust the primary roll (0000), change the effective date, and add the school support.

- Adjust each subordinate roll, change the effective date, and do not enter anything into the third column.

- Do the billing. The amalgamated charges will be applied to the primary roll.

|