Introduction

While it has been designed to give you a comprehensive look at each property, it can be a bit overwhelming. There are several tabs along the top through which you can access a different aspect of the Roll. There are also 2 buttons for creating a new roll number and for searching an existing roll. As well, several tabs have their

own buttons which are usually used to print a report. Finally, along the bottom left there exists a group of buttons that function as a record selector. If you wish, rather than using the search button, you

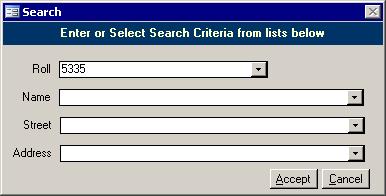

can manually scroll through the different rolls in the system using the record selector. They will be in the order according to the Sort by field in the bottom right corner of the screen.The first screen you

see when you go into the Tax Master is the Search screen. Use this to find the roll you need by choosing a roll from one of the lists.

Quick Tip: If the roll prefix is highlighted in black, simply press the F2 key to be able to

start typing the rest of the roll number without having to retype the system's default prefix. Inquiry

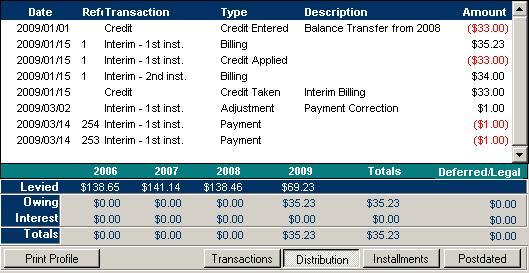

It is useful to be able to look up the current status of any roll. The Inquiry tells you the

outstanding amount for each property, and is included in both the Tax Inquiry and the Tax Master forms. There are four different views on this tab: Transactions,

Distributions, Installments and Postdated Cheques. These views are described below. You can also click the Print Profile button to see the account status in a report format. Transactions

The transaction view shows a list of events that are easy to explain. A property owner looking at this screen will quickly understand what they were charged and how their

payments were applied; however, the Amounts do not add up to the total. On the far left in the green bar may be a number. In the above picture, that number is $35.67

which represents the amount due next month after interest has been added to any arrears. Note: The red asterisk on the far left denotes a pending transaction. Distributions

This screen shows all transactions. This is used when the property owner does not understand why the Transactions screen does not add up. The Credit Taken entries

seem to confuse many people, so we have made them available, but they do not show up by default. Installments

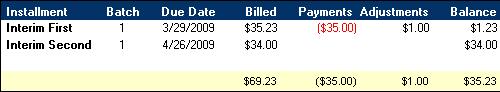

The Installments screen simply shows the current outstanding amounts with their due

dates. If more than one batch was run, which can be done when 1055 capping is finished, then you would see multiple Interim First entries. There will be one per batch.

Adjustments will appear only if they affected one of the billing installments. If the adjustment was made against Credit, then it will not appear in the Adjustments column in the above picture. Postdated Cheques

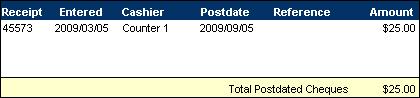

If any postdated cheques have been received for the roll, then they will be listed here. When a postdated cheque is processed during the End of Day routine, the cashier will

probably change then, but for now, the cashier listed is the person who entered the initial receipt.

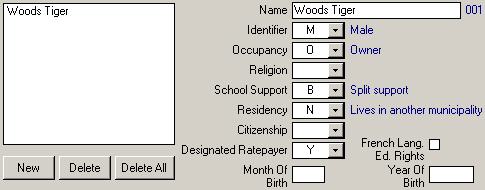

Names

To change the information of someone associated with a Roll number, perform the following steps:

- Bring up the Tax Master.

- Left click on the Names tab at the top.

- Left click on the name of the person in the box on the left.

- Change the information in the fields on the right. For example, Click in the Name field, make any necessary changes, then press the Tab key. The name that

appears in the box on the left will be updated automatically to reflect your changes.

Changing the Owner

- Click the Delete All button.

- Key in the new owner's information.

- Add any other names once the main owner is done.

If you do not delete all, then the main name/occupant will not be assigned the sequence number of 001 (the sequence number appears in blue text to the right of the Name

field). For example, if a current occupant who is not the main occupant buys/inherits the property, their current sequence number will be 002 or higher. If you delete all other

occupants one at a time leaving only the new owner, the new owner's assigned sequence will not change. A Roll must have a name/occupant with a sequence number of 001 and an occupancy

status of Owner for a bill to be generated and for them to appear on the Collector's List.

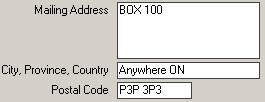

Address

This is just the mailing address. This can change during the SAS Update, and you can use the Address Changes form and report to view a list of the addresses that have changed addresses.

That report is useful to send to the Municipal Property Assessment Corporation rather than writing them all out by hand. This will make sure no address changes are missed. This is just the mailing address. This can change during the SAS Update, and you can use the Address Changes form and report to view a list of the addresses that have changed addresses.

That report is useful to send to the Municipal Property Assessment Corporation rather than writing them all out by hand. This will make sure no address changes are missed.

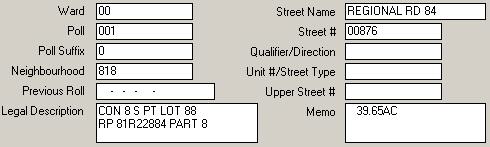

Location

This screen contains the voting and location information. Most municipalities use the Street Name, Street Number, Direction, and Unit Number for the 911 addresses. The

problem is this data is overwritten during the SAS update. If the data is wrong or incomplete, then someone has to re-key in the fixes each year. Instead, the Baker and

Associates 911 system will keep track of the 911 addresses and can update the data on the above screen. As well, the 911 system can maintain more than one 911 address per

roll unlike this screen which can only track one location per roll.

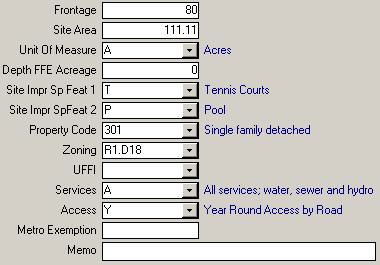

Property

This stores property characteristics for all primary entries and site dimensions for certain

subordinate entries. Here is a brief explanation of the lesser known fields:

- The Frontage is the width of the lot in feet.

- The Site Area has its units specified.

- Depth FFE Acreage is the property depth on all primary records that are outside the property code range of 200 to 299. If it is within that range, this field holds the Farm Forestry Exemption acres.

- There are two Site Improvement and Special Features fields which indicate the existence of structures that affect market value of the property like the following:

Boat house, pool, elevator, sauna, tennis courts, etc.

- Zoning shows the zoning code of a property.

- UFFI field indicates whether the structures have, or once had, urea formaldehyde foam insulation.

- Access indicates the means of access to a property.

- Metro Exemption may not be used anymore.

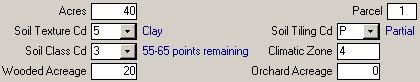

Soil Parcel

Soil Parcel contains information about various types of soil conditions on each property.

- Parcel Acres shows the total number of Acres for that particular soil parcel

- Texture describes for each soil parcel the relative amounts of sand, silt, clay minerals and organic material in the soil, or the parcel is non-farm.

- Soil Class is a 1 digit code reflecting indirectly the points remaining.

- The Tiling code indicates the presence of tiling to improve drainage.

- Climatic Zone indicates the geographic location of the property in terms of the length of the growing season and annual minimum temperatures.

- Wooded Acres is the acres of woodland

- Orchard Acreage is the acres of orchard.

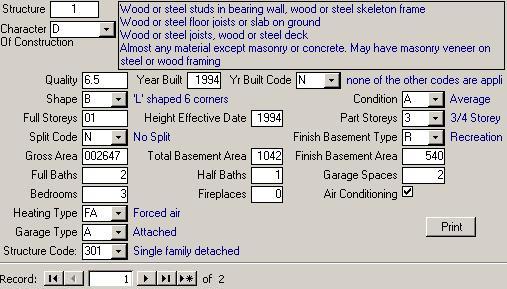

Structure

Listed here are the details about each structure on the property. Most of the fields here are self explanatory.

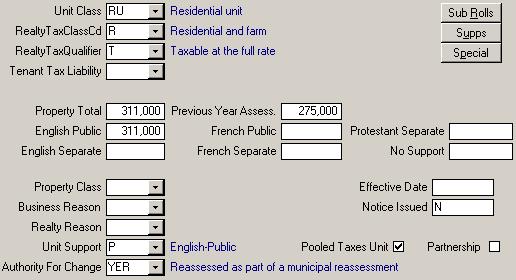

Assessment

The information here indicates the value and tax billing information on each property or portion. Some of the fields are described below:

- Unit Class code indicates the use for a unit assessable in separate occupancy.

- Realty Tax Class indicates the rate of tax liability and/or the rate at which Payments-in-Lieu on realty assessments are made.

- Property Total records the total Assessed Value for the property.

- Unit Support defines the school support designation attached to the unit.

- Pooled Taxes identifies assessable units owned/occupied by Designated Rate Payers. The education taxes collected are divided among the school boards having jurisdiction in the municipality.

- Partnership identifies assessable units where in the owner/tenant partnership has exercised its right to have the education taxes that they pay divided among the

school boards having jurisdiction in the municipality.

- Authority For Change and Realty Reason codes record the legislative basis by which the last change to an entry was made.

- Notice Issued has an N on all roll entries for which a Normal assessment notice was issued. An A indicates an Amended assessment notice was issued.

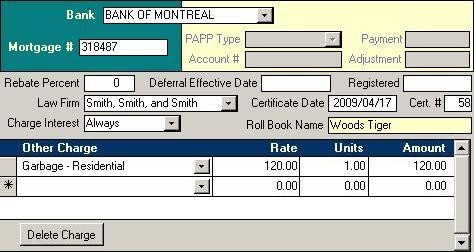

Taxation

The top section is used for tracking mortgage numbers or Pre-Authorized Payment Plan

data. When there is data in the Mortgage box, the PAPP boxes are disabled and vice versus. Below that is other taxation data stating when a tax certificate was issued, to

what law firm, and with what certificate number. The Charge Interest box allows you to determine which rolls get charged interest. There are three choices: Always, Never and

Skip Next Run. While most are set at the default of Always, you could give one property a break and set them to Skip Next Run. The next time Interest Wizard is updated, all

rolls that are set to Skip Next Run will be reset to Always. The Never setting is great for PILs who like to receive a tax bill instead of a letter. After their three month interest

free period is up, change this back to always and they will be charged interest with everyone else who is past due. Beside the Charge Interest box is a read only Roll Book

Name field. This will be updated with the SAS Update

from MPAC and will not change all year. This will provide fast access to the name of the owner as of the November data freeze at MPAC. There is also a box to put the date the property was registered.

Registered billsOther Charges are used to adjust the tax bill. Usually it is used to add a Municipal

charge like garbage collection; however, this in not always the case. Sometimes the government changes the tax rules such that several rolls taxes for previous years are

altered. This change is applied during the billing run and is done so by adding an adjustment. These adjustments are applied via an other charge.

There are two steps to entering Other Charges: Adding the category then, using the Taxation tab shown above, assigning the charge to all the Rolls to whom the charge applies. Creating Other Charges To enter a new charge category, go to the Other Charges form found on the Tax Menu.

If you choose to split a charge between the interim and final bill, the rate will be halved on each bill. Assigning Other Charges Adding a local improvement charge to a roll is fairly painless, just make sure you add it to

the subsidiary roll if one exists. This will stop the charge from appearing on all bills when commercial and residential are billed separately. All you have to do is select the charge

category from the list and input the units, or number of times this charge should be applied to a roll. The rate comes up automatically and the Amount is calculated when you add the units. Deleting Other Charges

Deleting is easy as well. Simply click on the name of the charge you wish to delete and click the Delete Charge button. This charge will not show up on the next bill generated for this property.

Tasks

Add/Edit: Add/Edit: Opens the Tax Adjustments form for the current roll.

Register: Distribute the adjustments and view the

Tax Adjustments register.

Write Offs: Using the minimum amount set in the Notice of Arrears Options screen, adjustments will be generated for all transactions where the amount owing is less than that minimum.

Bills Buttons: Print a copy of the interim, final or supplementary bills after the billing has been run. Using the Open Database form found under the File pull down

menu to open an archive database will give you the opportunity to reprint a bill from a previous year. If you are printing a bill that was printed by us on 11x17

paper, simply rip a blank bill form in half along the vertical perforations and place in the printer before printing.

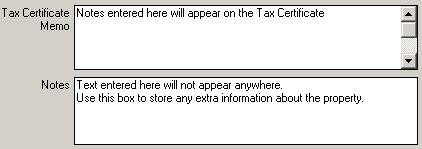

Notes

There are now two memo fields in the Tax system that get saved from year to year. They show up on the Notes tab of the Tax Master as shown below.

The data in the top box will appear on the Tax Certificate, but the bottom is for Municipal staff use only. |