Introduction This wizard walks you through processing interest for past due rolls.

Usually Interest is added to overdue accounts at the beginning of each month after the due date has past. This system allows you to enter different Interest rates for each due date that has gone by. Before

the interest register is generated, the amount of interest for each roll is calculated and added to its account as a pending transaction. If you cancel out of this Interest Wizard before updating, these pending

transactions are deleted and will not show up on a Tax Inquiry.There are other settings that affect interest. In the Setup Wizard, you can choose whether or not rolls that owe less than the minimum amount will be charged

interest. That minimum amount is set using the Notice of Arrears Options screen, As well, the Taxation tab of the Tax Master has a Charge Interest field that determines which rolls get charged interest.Note: Interest is only calculated on the principal owing.

Compound interest is not allowed.

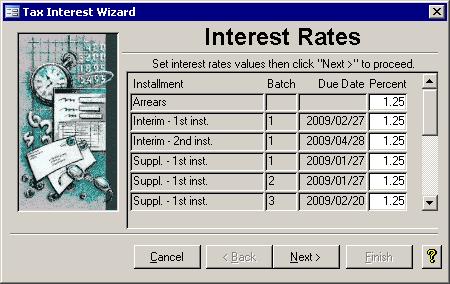

Step 1: Interest Rates Step 1: Interest Rates

This step allows you to change the interest rates that will be used in calculating the

amount of interest. You can even apply a different rate for each due date if you need to do so. If the Percent field in the table is greyed out or you get a message when you

try to change it from 0.00, then the due date has not yet passed, and no interest will be charged on those amounts still due. The percentage defaults to 0.00 and must be

changed for interest to be charged on the current year installments.

Step 2: Interest Register Report Step 2: Interest Register Report

The

Interest Register report shows all interest charges

that will be applied if the user does not cancel out before completing the last step of this wizard. It is sorted by roll number and grouped by the map number. The map number is the first 10 digits of the

roll number and is made up of the four digit municipality number and the three digit division and subdivision numbers. The PAPP column will have a D (Due Date), A (Arrears), or M (Monthly) if that

property owner has signed up for the Pre-Authorized Payment Plan. The

Interest Register report shows all interest charges

that will be applied if the user does not cancel out before completing the last step of this wizard. It is sorted by roll number and grouped by the map number. The map number is the first 10 digits of the

roll number and is made up of the four digit municipality number and the three digit division and subdivision numbers. The PAPP column will have a D (Due Date), A (Arrears), or M (Monthly) if that

property owner has signed up for the Pre-Authorized Payment Plan.

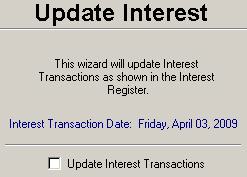

Step 3: Final Update Interest Step 3: Final Update Interest

Before you update, make sure the Interest Register is correct. If it is not correct and you update anyway you will either have to do manual tax adjustments or you will have to restore from

backup. Depending on how much work was done since the last backup, that option may be more time consuming than doing manual adjustments, but manual adjustments make the property history

more difficult to read and understand. The Interest Transaction Date is taken from the computer system's internal clock.

Before you update, make sure the Interest Register is correct. If it is not correct and you update anyway you will either have to do manual tax adjustments or you will have to restore from

backup. Depending on how much work was done since the last backup, that option may be more time consuming than doing manual adjustments, but manual adjustments make the property history

more difficult to read and understand. The Interest Transaction Date is taken from the computer system's internal clock.

|