Introduction This wizard quickly walks you through the creation of next year's

database. It is done at the end of the current year, so you can have a fresh start for the next fiscal year. Make sure you are done with the current year before going onto the next year. The opening

balances created during this Year End wizard cannot be changed other than by doing Tax Adjustments.

Step 1: Options

Step 1: Options

If a good backup has been verified, put a check in the box. The box must be checked off for the Next button to be enabled.

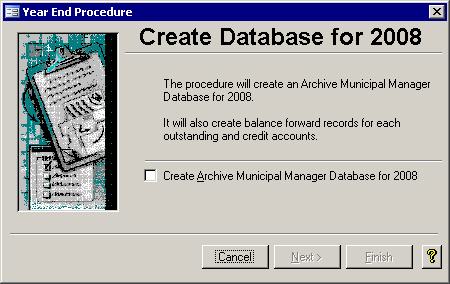

Step 2: Create the Database Step 2: Create the Database

This is the step where everything happens.

You don't have to click anything else to get it started though. It starts up automatically. The following tasks are performed for you: This is the step where everything happens.

You don't have to click anything else to get it started though. It starts up automatically. The following tasks are performed for you:

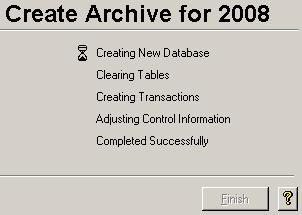

- The new database is created to preserve the previous year's data

- The transaction table in the current year is cleared out as are traces of past billings

- Opening balances are created for both Arrears and Credit amounts

- Billing schedules and batch numbers are reset

- Levied amounts for the previous year are calculated

- A General Journal entry is created to move the amounts from the Current Taxes Receivable account to the Tax Arrears Receivable account

- The GL Update report is displayed on the screen

- The Effective Year and the Current year are updated

When these tasks have been successfully completed, the Finish button will be enabled. Simply click on the Finish button to close the wizard.

|