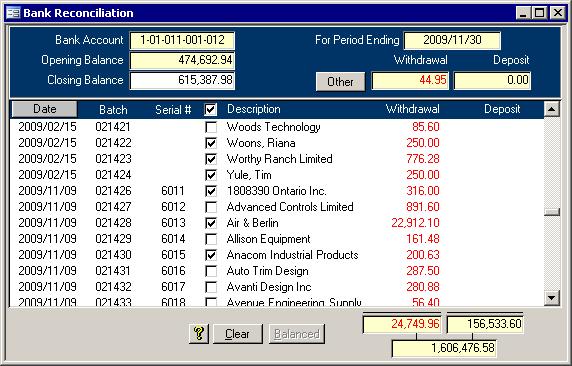

Introduction It is important to be able to compare and check off your transactions versus

the entries on the monthly bank statement. This is done using the Bank Reconciliation form. It also allows access to enter missing transactions without doing a separate journal batch.

Using the Bank Reconciliation Form There are only six steps to doing a bank reconciliation:

- The first step is to choose a Period Ending. All non-reconciled transactions and cheques that have a date of less than or equal to the Period Ending date will show up. If the desired date is already

in the Period Ending box and you are missing cheques that show up on the Outstanding Cheque List report in the Accounts Payable system, then you will have to click the Cancel button at the bottom and re-enter

the Period Ending date.

- Next enter the Closing balance from the bank statement.

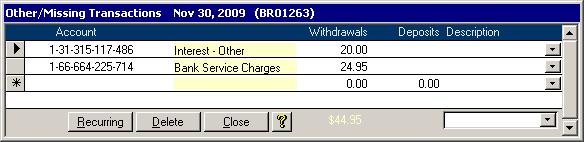

- Also, enter the bank charges, interest an any other missing transactions using the

Other/Missing Transactions form.

With that done, all you have to do now is go through the list and put a check in the box for each of the transactions that appear on the statement. Since the transactions on the form are listed by date,

this step should be easy. If you took the time to assign the now mandatory cheque serial numbers

, then you can use the data in the Serial # column to make your job easier.

Once the Closing balance and the total at the bottom match, you should be done. Click the Balanced button to get the Bank Reconciliation report.

If the Bank Reconciliation report matches the statement, close the report and commit the transactions as being returned/reconciled.

The next section details entering the Other/Missing Transactions.

Other/Missing Transactions

When a bank statement is received, inevitably, it will contain some transactions, like

interest and service charges, that have not yet been posted to the General Ledger. This screen is used to enter these missing transactions. The entries on this form will

appear at the bottom of the Bank Reconciliation report, and when that report is committed, they will be inserted into the General Ledger. An extra transaction for the

bank account being reconciled will also be inserted as well in order to balance the new entries. The Period Ending date is used for all missing transactions. You can use the

Journal Entry form if you prefer to use different dates.

An easy way to add monthly charges is to use the recurring charges pull down list. All recurring charges that affect the bank account being reconciled will appear in the list.

When one is selected, the non-bank entries will be inserted into this form. If you want to add more recurring charges or edit an existing recurring charge, you can do so by

clicking the Recurring button. You do not have to use the Recurring Journal Entries form to edit the amounts. After you commit the Bank Reconciliation Register, the values on

the Recurring Journal Entries form will be updated. Go to the Recurring Journal Entries form for more information. |