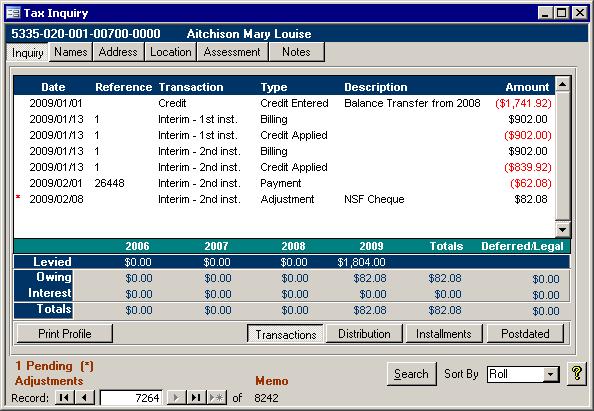

Introduction The Tax Inquiry has been designed to give you essential information about each

property. This is available through the Cash Receipts Menu as well as in the Cash Receipts Entry screen. There are several tabs along the top through which you can access a different aspect of the

Roll. There is also a Search button for finding an existing roll. At the bottom exists a group of buttons that function as a record selector. If you wish, rather than use the search button, you

can manually scroll through the different rolls in the system using the record selector controls. The records will be in the order according to the Sort by field in the bottom right corner of the screen.

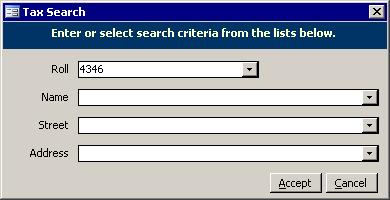

Unless you used the Inquiry button from the Tax tab

of the Cash Receipts Entry form, the first screen you see when you go into the Tax Inquiry is the Search screen. Use this to find the roll you need by choosing a roll from one of the lists.

Quick Tip

: If the roll prefix is highlighted in black, simply press the F2 key to be able to start typing the rest of the roll number without having to retype the system's default roll prefix.

Inquiry

It is useful to be able to look up the current status of any roll. The Inquiry tells you the outstanding amount for each property. There are four different views: Transactions,

Distributions, Due Date and Postdated Cheques. These views are described below. Transactions

The transaction view shows a list of events that are easy to explain. A property owner looking at this screen will quickly understand what they were charged and how their payments were

applied; however, the Amounts to not add up to the total. Note: The asterisk denotes a pending transaction. Distributions

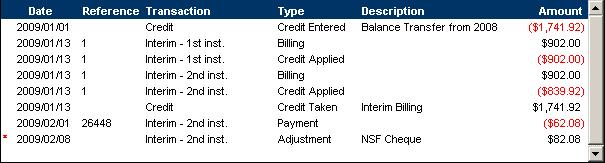

This screen shows all transactions. This is used when the property owner does not understand why the Transactions screen does not add up. For some reason, the Credit Taken entries seem

to confuse many people, so we have made them available, but they do not show up by default. Installments

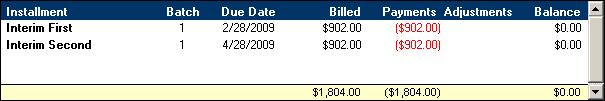

The Installments screen simply shows the current outstanding amounts with their due dates. If more than one batch was run, then you could see multiple Interim First entries. There will be

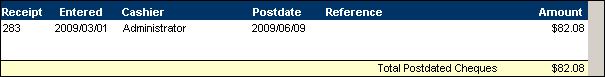

one per batch. Final and Supplementary billings will appear here as well if the current roll was included in those billing runs. Postdated Cheques

If any postdated cheques have been received for this roll, then they will be listed here. When a postdated cheque is processed during the End of Day routine, the cashier will probably change

then, but for now, the cashier listed is the person who entered the receipt.

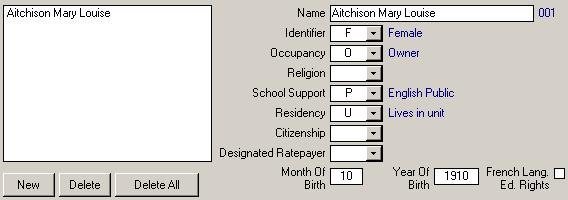

Names

To change the information of someone associated with a Roll number, perform the following steps:

1. Bring up the Tax Inquiry.

2. Left click on the Names tab at the top.

3. Left click on the name of the person in the box on the left.

4. Change the information in the fields on the right. For example, Click in the Name field, make any necessary changes, then press the Tab key. The name that appears in the box on the left

will be updated automatically to reflect your changes. Changing the Owner

1. Click the Delete All button.

2. Key in the new owner's information.

3. Add any other names once the main owner is done.

If you do not delete all, then the main name/occupant will not be assigned the sequence number of 001 (the sequence number appears in yellow in a box after the name field). For example, if a

current occupant who is not the main occupant buys/inherits the property, their current sequence number will be 002 or higher. If you delete all other occupants leaving only the new

owner, their assigned sequence will not change. A Roll must have a name/occupant with a sequence number of 001 and an occupancy status of

Owner for a bill to be generated and for them to appear on the Collector's List.

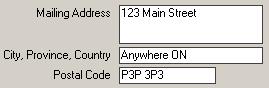

Address

This is just the mailing address. This can change during the SAS Update, and you can use the Address Changes form and report to view a list of the addresses that have changed addresses.

That report is useful to send to the Municipal Property Assessment Corporation rather than writing them all out by hand. This will make sure no addresses are missed.

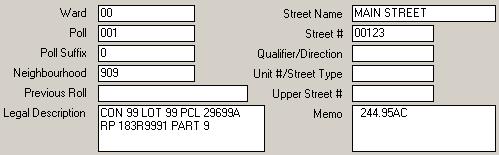

Location

This screen contains the voting and location information. Most municipalities use the Street

Name, Street Number, Direction, and Unit Number for the 911 addresses. The problem is this data is overwritten during the SAS update. If the data is wrong or incomplete, then someone

has to re-key it in. Instead, the Baker and Associates 911 system will keep track of the 911 addresses and will update the data on this screen when instructed. As well, the 911 system

can maintain more than one 911 address unlike this screen which can only track one location. This is important for rolls that have more than one driveway like a ski hill that has one main

driveway and another to a maintenance shed.

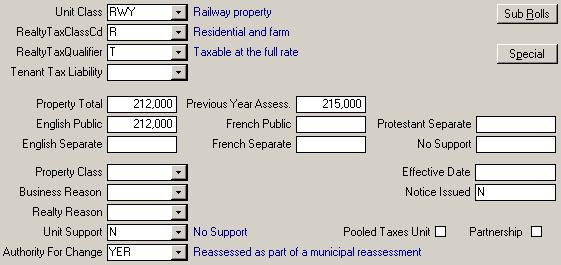

Assessment

The information here indicates the value and tax billing information on each property or portion.

Some of the fields are described below:

- Unit Class code indicates the use for a unit assessable in separate occupancy.

- Realty Tax Class indicates the rate of tax liability and/or the rate at which Payments-in-Lieu on realty assessments are made.

- Property Total records the total Assessed Value for the property.

- Unit Support defines the school support designation attached to the unit.

- Pooled Taxes identifies assessable units owned/occupied by Designated Rate Payers. The education taxes collected are divided among the school boards having jurisdiction in the municipality.

- Partnership identifies assessable units where in the owner/tenant partnership has exercised its right to have the education taxes that they pay divided among the school

boards having jurisdiction in the municipality.

- Authority For Change and Realty Reason codes record the legislative basis by which the last change to an entry was made.

- Notice Issued has an N on all roll entries for which a Normal assessment notice was issued. An A indicates an Amended assessment notice was issued.

|