Introduction As autumn approaches, the Treasurer, with input from the school boards, figures

out what that year's tax rates should be. When Council approves the final tax rates and the percent increase over last year has been determined, the amounts left owing by the Pre-Authorized Payment Plan rolls has

to be recalculated. For example, if this years taxes were estimated to be 4 per cent higher than last years, and the final tax rates end up only being 3.5 percent higher, then the amount of the last payments will

go down. Of course the opposite could be true. If the final tax rates end up being over the estimated 4 per cent then the last payments will be higher. This wizard is used to recalculate these payments.

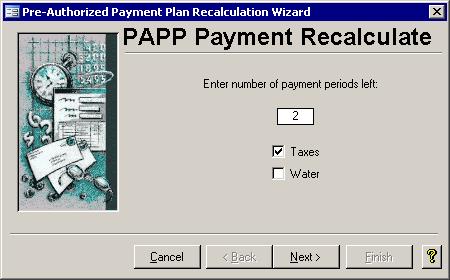

Step 1: Entering Number of Payments Left Step 1: Entering Number of Payments Left

While the rest of this wizard is similar to the Payment Preparation Wizard, this first step is unique. You must enter how many more payments will be made this year using the Payment Request Wizard. If you do not request a payment in December and January

through to September have already been paid, then you have two payment periods left: October and November. If you waited until after the October payment has been

requested, you will only have one more payment period left. If you have already done the November payment, then you will probably have to manually adjust each person's

account and you have a lot of work ahead of you. Once you determine how many payment periods you have left, put that number into the white field on the screen. If

you have PAPP for Water enabled in the Setup wizard, you can opt to recalculate both Taxes and Water, so they will both appear on the mail merge letter in Step 3. Click the Next button to continue.

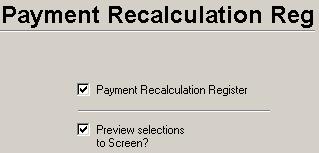

Step 2: Printing the Recalculation Register Step 2: Printing the Recalculation Register

This

register shows the Current Due, the Previous payment amount, and the New

payment amount. The New values are calculated by dividing the Current Due by the number of payment periods left that you entered in

Step 1. You may get a second register if you Chose to process Water PAPP as well. Before you click the Next button to continue,

please check the numbers on this form with the Tax Inquiry to make sure they are correct. If any are wrong now, they will show up incorrectly in the mail merge letters created in the next step. This

register shows the Current Due, the Previous payment amount, and the New

payment amount. The New values are calculated by dividing the Current Due by the number of payment periods left that you entered in

Step 1. You may get a second register if you Chose to process Water PAPP as well. Before you click the Next button to continue,

please check the numbers on this form with the Tax Inquiry to make sure they are correct. If any are wrong now, they will show up incorrectly in the mail merge letters created in the next step.

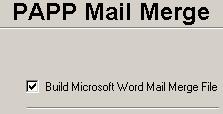

Step 3: Generating Data Step 3: Generating Data

This step of the PAPP will be used to generate the data needed for a letter to be sent to the property

owners. Designed similar to the Mail Merge letter used in the Payment Preparation Wizard, this step will create a data file to be merged with the master document. When Microsoft Word is launched, the

master document will appear which can be edited as you see fit. This step of the PAPP will be used to generate the data needed for a letter to be sent to the property

owners. Designed similar to the Mail Merge letter used in the Payment Preparation Wizard, this step will create a data file to be merged with the master document. When Microsoft Word is launched, the

master document will appear which can be edited as you see fit.

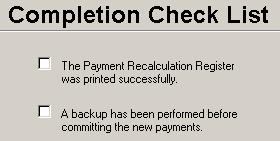

Step 4: Finishing Step 4: Finishing

This screen gives you a chance to make sure the register and the letters are all correct and that a backup has been performed. If a

backup has not been done and you later notice an error, you cannot go back and just rerun this wizard because the previous payment amounts will be wrong. If there are no problems, then checking off the two boxes

once they have been done and clicking the Finish button will update the payment amounts in the table and will close the wizard. This screen gives you a chance to make sure the register and the letters are all correct and that a backup has been performed. If a

backup has not been done and you later notice an error, you cannot go back and just rerun this wizard because the previous payment amounts will be wrong. If there are no problems, then checking off the two boxes

once they have been done and clicking the Finish button will update the payment amounts in the table and will close the wizard.

|