Introduction Done at the end of the year after the final billing, this wizard steps you

through calculation of Pre-Authorized Payment Plan payments. Rolls signed up for the Monthly PAPP need their taxes recalculated each year. This is done at the beginning of the year, and the percent increase

is estimated at then. While Arrears PAPP have payments removed monthly, they are a special case and are not recalculated each month.Note: Currently, you must have Microsoft Word installed on a system that can

access the data created by this wizard.

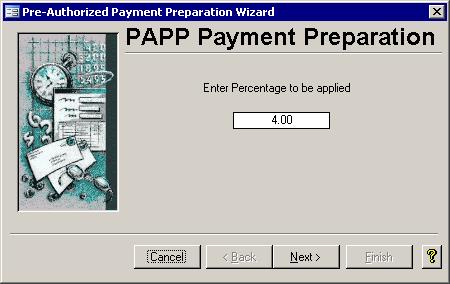

Step 1: Estimated Percentage Increase

This rate is determined at the discretion of the Treasurer and Council. If there is a

Bylaw on the books freezing the tax rates, this percentage would have to be zero. If the actual taxes do not increase as much as was used for this estimate, then the

taxpayers' last payment would go down. Conversely, if this estimate is too low, then their last payment will be larger than the other monthly payments.

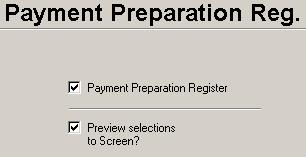

Step 2: Payment Preparation Register

This step prints a

register which simply indicates what the levied amount was, and what

the new payment will be. The system settings for number of months is used in the payment calculation.

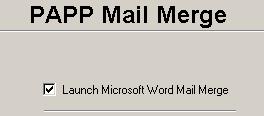

Step 3: Mail Merge Letter to Taxpayers  Microsoft Word will now be launched opening up the Payment Recalculation Mail Merge document. This document can be edited by you and the

letters it produces are mailed to the land owners notifying them of the change in their PAPP amount. The figures here should perfectly match those found on the register report printed

in the last step. If it does not, do not continue onto the next step until the error has been corrected.

Microsoft Word will now be launched opening up the Payment Recalculation Mail Merge document. This document can be edited by you and the

letters it produces are mailed to the land owners notifying them of the change in their PAPP amount. The figures here should perfectly match those found on the register report printed

in the last step. If it does not, do not continue onto the next step until the error has been corrected.

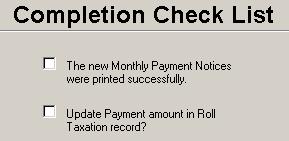

Step 4: Complete

After you verify the Payment Notices all printed and the values are correct such that they can now be mailed to the taxpayers,

you can now check off these two boxes and click Finish to close this wizard. After you verify the Payment Notices all printed and the values are correct such that they can now be mailed to the taxpayers,

you can now check off these two boxes and click Finish to close this wizard.

|