Introduction

This wizard takes you through setting up the system information. It is automatically run when you first launch Baker and Associates software for the first time. If you do not complete the wizard, it will continue to

run when you first enter the system. Once it has been finished, it can be run at any time by the administrator. It is accessible through the Asset menu.

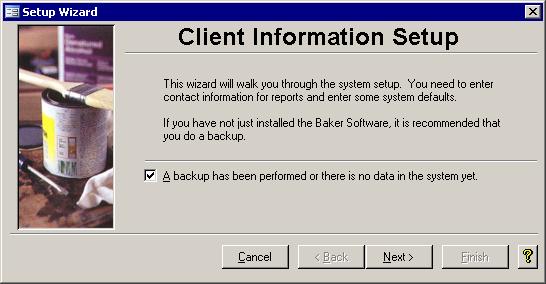

Step 1: Checklist Step 1: Checklist

Before you can begin you have to back up the system to save the previous configuration. If you are running this Baker and Associates software for the first time, you can just

check off the box by clicking in it with the mouse. Click Next to continue on.

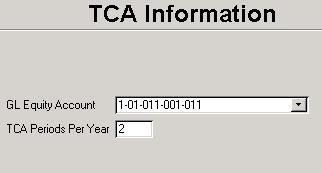

Step 2: TCA Information Step 2: TCA Information

For now, there is only one extra step. It is titled the Tangible Capital Asset

(TCA) Information screen which is where you specify some key data that governs how the amortization process works. This Asset Management system uses the following fields: For now, there is only one extra step. It is titled the Tangible Capital Asset

(TCA) Information screen which is where you specify some key data that governs how the amortization process works. This Asset Management system uses the following fields:

- GL Equity Account: Each time an asset is added or disposed, the account in this field will be used in conjunction with the asset account from the TCA Master screen. This

equity account will be credited when assets are added and will be debited when assets are disposed.

- TCA Periods Per Year: Each fiscal period will require the depreciation of assets to occur at least one time but usually twice. If you need to run the amortization

routine more than twice, then you will need to increase this above the default 2.

|

For now, there is only one extra step. It is titled the Tangible Capital Asset

(TCA) Information screen which is where you specify some key data that governs how the amortization process works. This Asset Management system uses the following fields:

For now, there is only one extra step. It is titled the Tangible Capital Asset

(TCA) Information screen which is where you specify some key data that governs how the amortization process works. This Asset Management system uses the following fields: